EMEA

Forbury

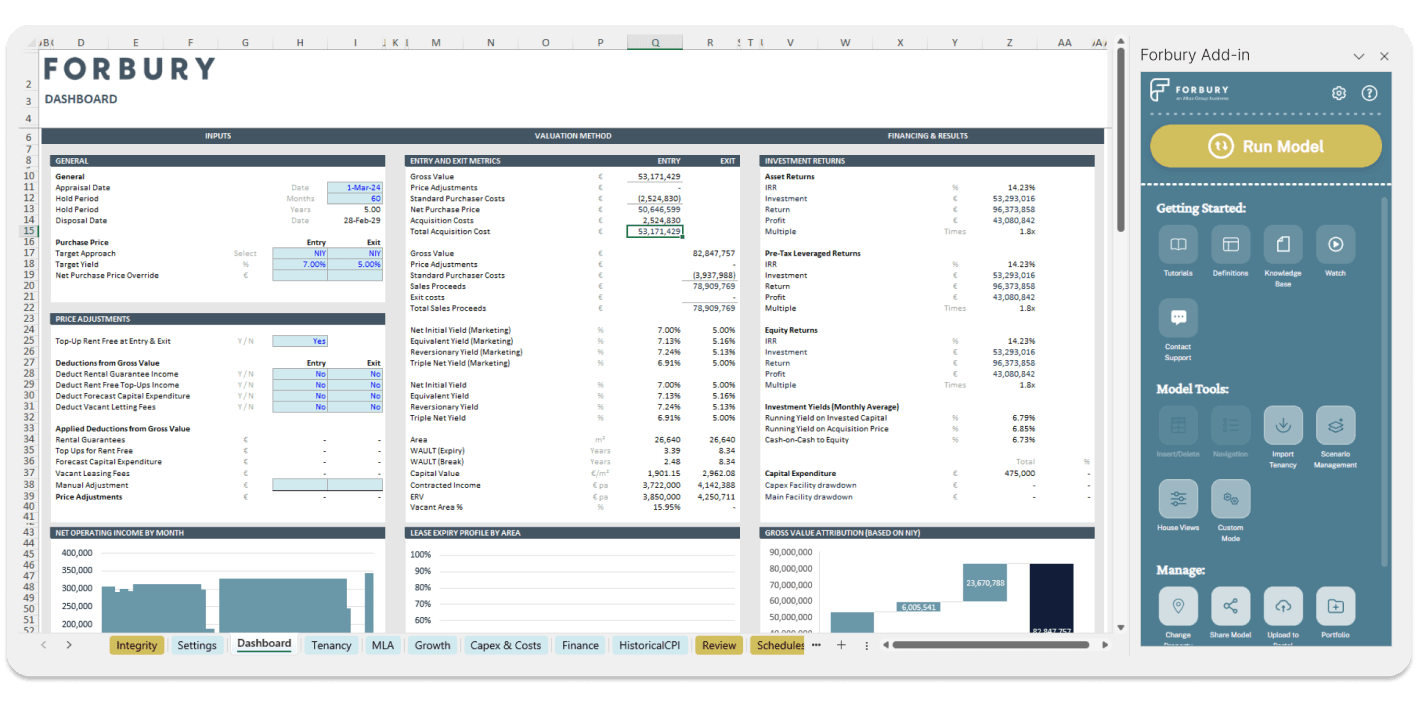

Commercial real estate appraisal and investment modelling software.

DISCOVER FORBURY

Streamline your modelling workflows

Forbury delivers intuitive and powerful investment tools for valuations, appraisals and strategic analytics, enabling you to assess the returns and value of your commercial assets throughout the CRE lifecycle.

Experience even more with Forbury

Accuracy and precision tools

Trust the accuracy of your model with built-in integrity checks, version controls, and error alerts

Transparent logic

A familiar and intuitive Excel interface facilitates greater transparency and traceability of calculations

Model at pace

Get key metrics within 10 minutes with time-saving features and a powerful cloud calculation engine

Data-driven decisions

Detailed data offer valuable insights and advanced reporting capabilities enabling deliberate decision-making

Minimise data-entry

Import tenancy schedule data directly from PDF, Excel or ARGUS Enterprise to streamline processes and minimise the risk of manually entering data

Robust security

No VBA macro risks with the Forbury Add-in; rely on enhanced security and ISO/IEC 27001:2022 certification

How Forbury works

Simplify your investment modelling process

1. Populate your model

Import a tenancy schedule and input key assumptions to arrive at an IRR in 10 minutes. Layer on additional assumptions for the deals that deserve deeper analysis.

2. Create and compare scenarios

Dynamic scenario analysis within the same worksheet allows you to explore the various business cases without cluttered file management.

3. Roll up models to a portfolio

Assess the impact of a potential acquisition to your existing portfolio. View cashflow forecasts at the portfolio level.

4. Tailor your reports

Create custom reports fed by the model outputs for confident decision making. Present branded reports that are consistent and credible to your stakeholders.

Testimonials

Hear what our customers say

"The intuitive design allows us to turn around accurate appraisals with various scenarios and sensitivities faster."

Freddie MacColl, Partner - Capital Markets, Knight Frank

"The software is easy to use and intuitive and the support from the Forbury team throughout our journey so far has been first class."

Nick Penny, Head of Scotland - Savills

"I’d used Forbury previously and really liked the product, it was the only thing we wanted to use. I picked up the phone to Ed and said, “we’re starting a new business and would like to work with Forbury again”. It came from a desire to provide more for our clients, which using Forbury helps us achieve."

Ellie Kirkby, Partner & Co-Founder - Park Place Retail

FAQ

Get answers to commonly asked questions about Forbury

What sectors and regions does Forbury cater to?

How long does onboarding take?

What makes Forbury so fast?

What is the Forbury Add-in?

Does Forbury do DCF?

300+

customers globally

2,000+

users globally

~1M

calculation engine runs per year